Yes, 1% is really good.

I’m just afraid that is only a promotional offer for a short time.

After Investart, I take these too-good-to-be-true offers with a pinch of salt. Switzerland is a pretty small market, so you don’t have the critical mass factor which US services like Robin Hood, etc. benefit from.

That said, even if True Wealth does end up having a 0.225 fee, that’s still relatively cheap (just like Investart is still very competitive even after it introduced a fee). On the whole, I’m amazed at what is currently available on the Swiss market. These kinds of offers would have been almost inconceivable just 5 years ago.

One thing about the True Wealth pillar 3a: The retirement foundation which True Wealth partners with (Vorsorgestiftung 3a Digital) is in Basel which = high withholding tax.

That obviously only affects withdrawals when leaving Switzerland for countries without a relevant double taxation agreement.

Yes, I won‘t change as well.

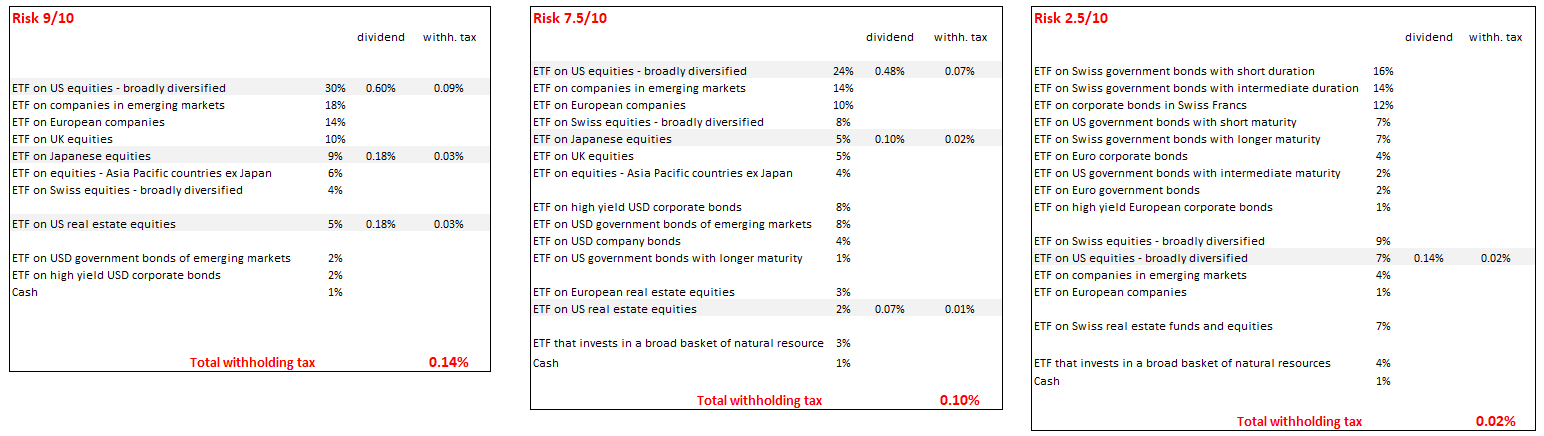

Withholding taxes on dividends apply to ETFs on equities and REIT from the US and Japan. Generally, for US equities, a withholding tax of up to 30% applies. Thanks to the tax domicile of our ETFs, the withholding tax on these dividends is only 15%. We have computed the effective foregone dividend income for three risk profiles under the following assumptions: equity dividend yield 2% p.a. and REIT dividend yield 3.5% p.a. We find the following results (values in % of the total portfolio value):

Foregone dividend income for

- risk tolerance 2.5/10: 0.02% p.a.

- risk tolerance 7.5/10: 0.10% p.a.

- risk tolerance 9/10: 0.14% p.a.

We are planning in the future to replace some of our ETFs with pension fund share classes of index funds for which this withholding tax can be further reduced to 0%.

You have not calculated L1 withholding taxes for other geographies (Emerging Markets, Europe). According to my research, they are significant.

Note that LU ETFs do not report gross dividends and withholding taxes separately.

And why are you using FTSE Developed Asia Pacific ex Japan and MSCI Emerging Markets in the same portfolio? An amateurish mistake, I would say.

(1) This is not completely true. We are using index funds for many asset classes already. And through pooling and netting the effective stamp duties are lower than the nominal values of stamp duty.

(2) See our earlier answer: for low-risk profiles, the effect is 0.02% p.a. whereas for higher-risk profiles it goes up to 0.14% p.a.

(3) This is not a temporary offer – our plan is to stick with it and improve it even more the future by for example using even more (pension) index funds. In the history of True Wealth, we have never increased fees for any of our offerings, but instead reduced prices two times already (minimum fees and introduced degressive pricing). Extracts from our webpage:

- We believe: If you manage your third pillar with us, then sooner or later you will also entrust us with your free assets – this saves us advertising costs, which we prefer to spend on a better return on your pension provision. We charge a small fee for the free assets, but even this is extremely competitive thanks to automation.

- In existing client relationships, we do not incur any costs if we also manage a Pillar 3a. We are allowed to manage the funds ourselves because we have FINMA authorisation as an asset manager of pension assets – and therefore no one has to pay external licence fees.

This applies to the currency exposure of the fund (and not to the trading currency).

@True_Wealth where can we find the index/etf lists?

I was thinking of foreign withholding tax. If you use ETFs, you can’t reclaim 100% of the US withholding tax.

To our knowledge, the only relevant regions for which more tax efficient pension funds (as compared to ETFs we are offering) are used by Pillar 3a providers in Switzerland are the US and Japan. Therefore we think that comparing withholding taxes between 3a providers using ETFs or pension funds is only meaningful for the regions US and Japan. For any other regions, whether tax-efficient ETFs or pension funds are used, the tax treatment of dividends for investors domiciled in Switzerland is very similar or the same.

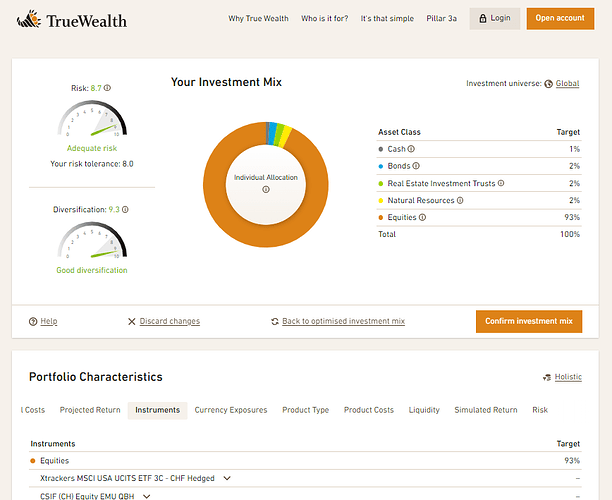

We have now made this list available on our homepage.

Open our sample portfolio and select the tab “Instruments”. If you want to see exclusively the instruments of Pillar 3a, select on top right “3a”. If you wish, you can modify the asset allocation of your portfolio and the instrument list is modified accordingly in real time.

…or the ones with a DTA but no refund.

In any case, you could transfer your funds to a Schwyz-based foundation later.

Wouldn’t that require a different, separate investment strategy though - something you currently (purposely) aren’t offering? I mean, you can’t offer the same (tax-privileged) “pension” funds outside of the 3a offer?

I am planning to close a normal 3a cash account at a swiss bank and transfert the amount (quite a big sum at least for me) to True Wealth but for cash only and benefit from the 1%.

Has anyone made the moove yet ? Are there any pitfalls or tiny footnote one should know before going for True Wealth ?

They ask Frs 100.-- when closing the account in the first 12 month. When closing the account later to moove the stack to an other 3a provider, will it be free of charge ? Sumed up : is the 3a cash money safe by True Wealth ? ![]()

As it is cash, it will be deposit on a « bank account » which is the Basel Kantonal Bank. So it will be « secure » by the 100k esisuisse insurance.

We plan to use more tax-priviledged “pension” funds in the future with our Pillar 3y offering. For our clients also managing their free assets with us, we will use ETFs for the corresponding asset allocation.

Put another way, our clients always have one portfolio with one strategy. The implementation, i.e. which instruments are being used to execute this strategy may differ between the assets invested in Pillar 3a and the free assets.

…or the ones with a DTA but no refund.

In any case, you could transfer your funds to a Schwyz-based foundation later.

Exactly. It’s just an important point to be aware of when it comes time to withdraw.

Overall I’m pretty impressed with the True Wealth pillar 3a offer. I’ve opened an account and will try it out to compare performance with my other pillar 3a solutions.

As it is cash, it will be deposit on a « bank account » which is the Basel Kantonal Bank. So it will be « secure » by the 100k esisuisse insurance.

Here is an extract from our FAQ

Your money is safe with us and the deposit guarantee is guaranteed. Even better: With us, your assets are even covered by a state guarantee. The cash is held in an account at Basellandschaftliche Kantonalbank (BLKB) – and the canton of Basle-Country is legally liable for all liabilities of BLKB.

There is therefore no upper limit to the invested cash at the custodian bank backed by the canton.

This looks surprisingly interesting. Surprisingly, since I originally dismissed it as a temporary lure, but if fees stay low forever, I guess True Wealth now is the cheapest investment 3a on offer (or is there a cheaper one)?

What I am struggling with: What will be the overall fees at the end? What will I actually save compared to, say Frankly or Viac? Say for 99% stocks. TER for the ETFs is 0.15%. Then “minimal” portfolio optimization, transaction fees (how much is minimal, 0.01% or 0.10% or what?). And then 0.10% foreign currency transaction on the foreign stock part.

So:

0.15%

0.07% FX (1/3 Swiss, 2/3 global)

0.22% total so far

And how much more for the rest?

So:

0.15%

0.07% FX (1/3 Swiss, 2/3 global)

0.22% total so farAnd how much more for the rest?

0.15% TER

0.00-0.03% FX*

0.11% withholding tax**

-0.01% cash interest***

0.25-0.28% total

*The FX conversion costs are not annual since they only occur when money is added or withdrawn, the strategy is adjusted or a rebalancing is needed to correct the asset class weights. The effective FX annual costs are therefore rather in the 0.00-0.03% range (assuming you deposit new funds every year). Remark: our portfolio is currency-hedged and we aim at using CHF as trading currency as broadly as possible.

**With 99% stocks, the withholding tax on dividends is effectively about 0.11%. Remark1: this holds for about 40% allocated to US and JPN equities. Increasing/decreasing the weight of these regions increases/decreases the withholding tax. Remark2: the value we quoted above (0.14%) is higher because we use equities and REITs in the portfolio we recommend for high-risk tolerance. Without REITs, this effective withholding tax on dividends is reduced.

***We treat interest on cash as a negative cost (in this case 1% of portfolio x 1% interest).

Thank you very much for that detailed explanation! Looking like a good offer!

Here’s an excellent review of the Truewealth 3a Pillar. Once again, great job, @thepoorswiss ! Love your blogs, especially the ones on FIRE portfolios and safe withdrawal rates!

https://thepoorswiss.com/true-wealth-3a-review/

For me, Truewealth 3a is a big fat NO as long as they have this nonsensical CHF-limit.

“One major limitation is that you must have 35% Swiss francs in your 3a . Indeed, they are limiting foreign currency exposure to 65%. So, you must either invest heavily in Swiss shares or use currency hedging. This limitation is quite important and will hit your returns in the long term”

But I very much welcome you bringing some pricing competition to the scene, @True_Wealth !

Agreed. I love the customizability finpension 3a offers in this regard. That’s why I will stick with them as my preferred 3a choice, but the True Wealth 3a offering is IMO among the top 3 3a solutions available, and, depending on your individual preferences, is capable of being the best choice overall.